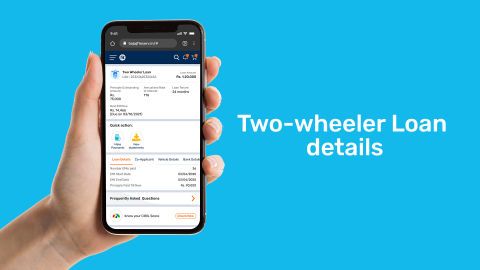

Track your two-wheeler loan account on our customer portal

Bajaj Finance Limited offers you a two-wheeler loan that helps you fund the purchase of your dream vehicle.

If you have an existing two-wheeler loan, and looking for details like EMI amount, rate of interest and more, visit our customer portal – My Account.

Sign-in with your registered mobile number and date of birth and use these features anytime.

-

Check loan details

View details such as EMI amount, its due date, annualised rate of interest and more.

-

Make payment

Part-prepay, foreclose a loan, or pay an EMI in advance in a hassle-free online process.

-

Download statement

Get your statement of account, and other related documents without any branch visits.

-

Get duplicate NOC

Raise a request for a duplicate no objection certificate and track its status online.

-

Bank account update

Make changes to your registered bank account easily in just a few clicks.

-

Check your two-wheeler loan account

Visit our customer portal – My Account to view your loan details.

Frequently asked questions

It takes approximately 48 business hours for your deducted EMI to get adjusted towards your loan account. You can check your updated statement of account by following these simple steps:

- You can click on the ‘Download your account statement’ text below to visit the customer portal – My Account.

- Enter the registered mobile number and an OTP to sign-in.

- Verify your details with the date of birth and proceed.

- Select the loan account for which you want to download the statement.

- Click on ‘Statement of Account’ to download it.

In case your EMI details are not updated even after 48 business hours, you can raise a request with us by clicking here.

Download your loan account statement

You are not required to pay any additional charges if you decide to part-prepay or foreclose your loan. However, you can part-prepay or foreclose your loan only after paying your first EMI.

You will receive your NOC once your loan is closed. You can foreclose your loan by paying the entire outstanding loan amount in one go. Once your loan is closed, your no objection certificate will be sent to your address registered with us.

Bajaj Finance Limited sends the NOC kit to your registered address within 10 business days of your loan closure.

Your NOC is valid for 90 days from the date of its issuance. You need to submit the NOC to the respective RTO within the validity period. This helps in removing Bajaj Finance Limited's hypothecation from your Registration Certificate (RC).

In case your original NOC expires or gets misplaced, you can follow these simple steps to raise a request for a duplicate NOC:

- Click on the ‘Get your duplicate NOC’ text given below to visit the customer portal – My Account.

- Sign-in with your registered mobile number and an OTP.

- Verify your details with your date of birth.

- Click on the ‘Duplicate NOC’ option in the ‘Quick Actions’ section.

- Confirm your residential address and proceed to submit your request.

- Once you submit the request, we can send the duplicate NOC to your registered address.