Loan settlement with Bajaj Finance

If you’re unable to repay your loan due to an unforeseen circumstance, loan settlement can be an option for you to close your loan. Loan settlement is an agreement between the lender and the customer as per which your lender offers you a loan settlement amount. This loan settlement amount is less than your actual outstanding amount. However, a loan settlement is offered only to select cases depending on your lender’s policy. If you’ve borrowed a loan from Bajaj Finance and there’s a need for you to opt for a loan settlement, you can connect with us through these channels.

- Call our customer care number +91 8698010101 to connect with our representative.

- Write an email to wecare@bajajfinserv.in and learn about the loan settlement option.

- Visit our branch nearest to your location to learn more about loan settlement.

-

Check your loan details

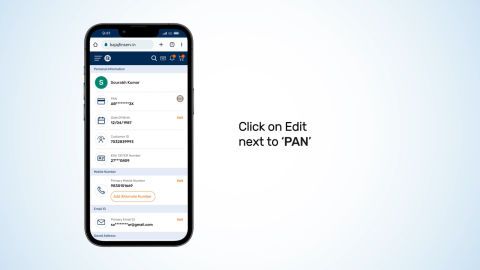

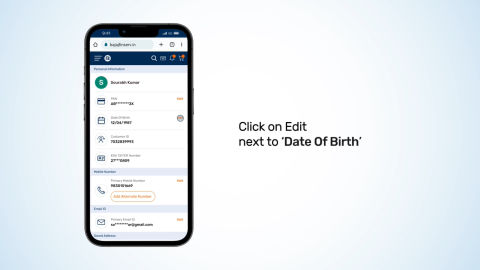

Sign-in to My Account by entering your mobile number and the OTP.

Frequently asked questions

Loan settlement refers to an agreement between the lender and the borrower, wherein the latter is unable to pay off a portion of the loan.

If you’re unable to pay the entire amount, then in selective cases a loan settlement is offered based on your financial conditions. However, opting for a loan settlement may negatively affect your credit score and loan eligibility in the future.

The loan settlement process will have a huge impact on your credit score as it indicates that the account has been settled with a waiver.

When you settle a loan, Bajaj Finance reports this to the credit bureau resulting in lowering your credit score. It also impacts your future creditworthiness. This might affect your loan eligibility in the future, and you may not get loans in the future from any leading financial institutions.

Therefore, before you request a loan settlement, it’s essential to carefully consider the long-term impact on the credit score and future creditworthiness. It may be a good decision to consider other options to repay all the dues before settling the loan.

Once you contact the lender to discuss options for loan settlement and after verification, the final outstanding amount is decided. A loan settlement letter is generated, and you can then proceed with the payment. Once your payment is completed, you’ll receive the final settlement letter and the no dues certificate. After this, your lender updates the credit bureau that your loan has been settled and not closed.

Once your loan settlement is completed, you’ll receive a no dues certificate (NDC). In the NDC, it will be mentioned that you’ve opted for loan settlement to close your loan.