Track your gold loan account on our customer portal

Bajaj Finance Limited offers a loan against your gold jewellery that comes with simple eligibility criteria and minimal documents.

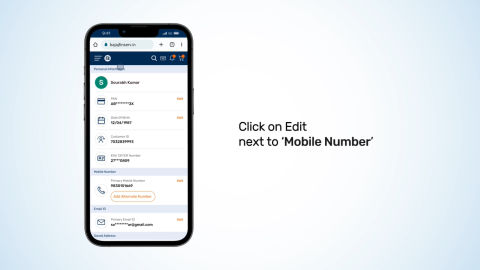

If you have a gold loan and are looking for more information about your ongoing loan, you can visit our customer portal – My Account. Sign-in to explore a host of self-service options on the go.

-

Check loan details

View details of your pledged gold jewellery, maturity date, the total amount due and more.

-

Download statement

Get the statement of account and other documents without any branch visits.

-

Manage payment

Make interest payments or part-prepay your loan in a few clicks.

-

Renew your loan

Extend the loan tenure of your ongoing gold loan in a hassle-free online process.

-

Get a top-up loan

Apply for a top-up loan and get extra funds with ease.

-

Check your gold loan account

Visit our customer portal – My Account to find details of your ongoing loan.

Frequently asked questions

You can view the due date for your next interest payment by following these simple steps:

- Click on the ‘View your loan details’ option to go to our customer portal – My Account.

- Sign-in with your registered mobile number and an OTP.

- Verify your details with the date of birth and proceed.

- Select the loan account number from the ‘My Relations’ section.

- Find details such as due date, outstanding loan amount, and more.

When you renew your ongoing gold loan, you need to pay the stamp duty charged as per your respective state laws. Apart from this, you have to also pay processing fees while renewing your gold loan.

If your loan eligibility is more than your current outstanding amount with Bajaj Finance Limited, you can get the balance amount as a top-up loan.

You need to pay only the stamp duty charges as per your respective state laws and the processing fee while applying for a top-up.

You’ll receive your top-up loan amount in your registered bank account within one business day of your request submission.

When you decide to foreclose your gold loan, you can make an online payment. However, you can’t pay the entire outstanding loan amount as some balance amount remains unpaid. This balance amount can only be paid at your gold loan branch.

Since you need to pay a certain part of the outstanding amount at our branch, therefore you can’t close the loan online.

Please note that you can foreclose your gold loan anytime without paying any additional charges. However, if you close the loan within seven days of booking, you have to pay the interest amount for minimum seven days.